As the latins said, Praemonitus praemunitus (Forewarned is forearmed)

A lot of people have already discovered virtual bank cards as a secure and convenient payment method. Some of them were advised to use them, some saw them mentioned in a media publication or in a post on Facebook.

Some of them discovered these cards in a hard way, looking for options after they had lost money. Those could have been pocket change — several dollars’ cost of a subscription not cancelled in time. Those could have been almost all of their money — in case of customers’ payment data leak from an online store to be abused by scammers.

People prefer to learn from the mistakes of others, but companies prefer it even more as the cost of a mistake is usually uncomparably higher.

So why do companies continue to use a traditional corporate credit card for business expenses? Why do accountants have to deal with paper checks in 2021?

Bank credit and debit cards have been designed for humans, and the financial infrastructure that backs them up is tuned to individual spendings. That is the source of most shortcomings and drawbacks of “physical” corporate bank cards. People had to deal with them when there had been no other options. But it is just a question of not so much time when fintech the almighty replaces old solutions with modern ones, and virtual cards will be one of the most demanded products.

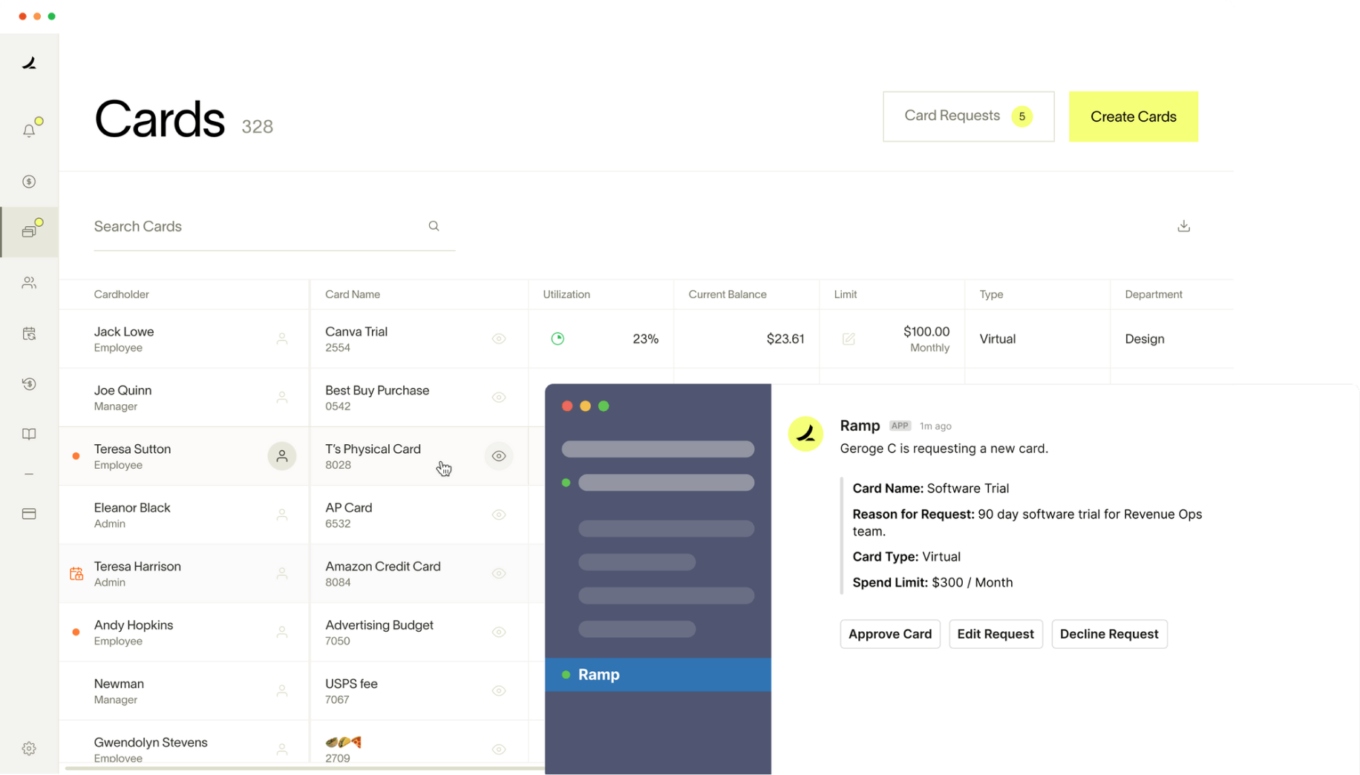

Startups that offer payment services including virtual cards are closing million-dollar funding rounds right as you read this. Ramp raised $115,000,000 back in April. Airwallex closed its ninth round in March, 2021 with total funding amount of $502M. Investors have recognized financial digital services as a hot trend with huge prospects.

What are those cards actually?

Virtual cards are debit or credit (sometimes gift cards, in general -- prepaid cards) issued and used online without any physical form. They are just a customized set of data merchants usually need to charge your bank account. A virtual card issuer uses your actual payment credentials to generate a sixteen-digit card number, expiration date, security code. Some of them can even provide a random cardholder name and a billing address if you need it.

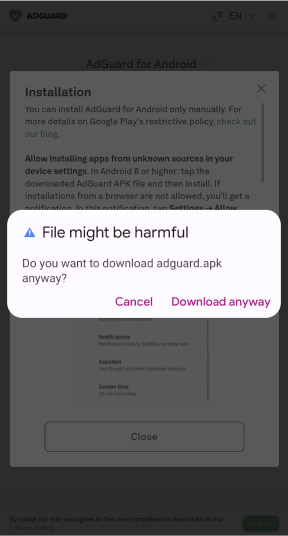

You can block this card after you’ve used it to sign up for a free trial if a vendor requires payment information, and you are not sure you’d want to continue to pay for subscription (or if you are sure you wouldn’t). You can set up a one-time (expiring after the first payment) card. You can set a limit of a payment amount. You can tie a card to a specific merchant — no hackers, scammers or other shops will be able to charge it.

Managing personal finance is a challenge, but managing corporate finance is an olympic discipline. Everything must be controlled and accounted, optimized, legally compliant, convenient for employees and counterparties…Money must be protected from scam and abuse and not wasted

on employees’ personal needs.

No wonder fintech apps and services are flourishing nowadays as businesses search for ways to spend money as smartly as possible.

What is there for you? It’s up to you.

It depends on what you are looking for. The research starts from defining your priorities and demands.

Your employees have to pay for goods and services while completing their business tasks. What is most important for your business?

financial security: you want your money, data, and information to be safe and stay only yours (unless you transferred them willingly);

control over the employees’ spends; they pay what they are supposed to pay for;

flexible settings and numerous functions: vendor-specific and category-specific cards, expenses analytics, colorful dashboards… there are really a ton of features offered, if you really need them.

lower price for the services or other benefits: cashback, affiliate programs, discounts, special offers from company’s partners;

the flexibility of a card provider: you want him to be ready to negotiate, to bargain, to customize their offer for you;

preventing your accountant and other financial department staff from going mad trying to reconcile multiple expenses and gather receipts;

reliability — the company is there for good, is known and trustworthy, has competent and accessible support.

If you care most for security and trustworthiness, try browsing b2b virtual card offers from big banks. Sadly, big banks of the West are currently not on the cutting edge of fintech innovation. Bank of America, for example, discontinued its virtual card service in 2019. Startups, on the other hand, are eager to construct a good deal, offer a disruptive feature, meet your special needs.

Here are some B2B virtual bank card providers you can choose from.

Mastercard and Visa utilize different approaches to the phenomenon. Visa

gives developers an API to access its infrastructure and build its own financial services, including the one in question. Mastercard

supports a broad “B2B Hub” that includes ready solutions for corporations and suppliers.

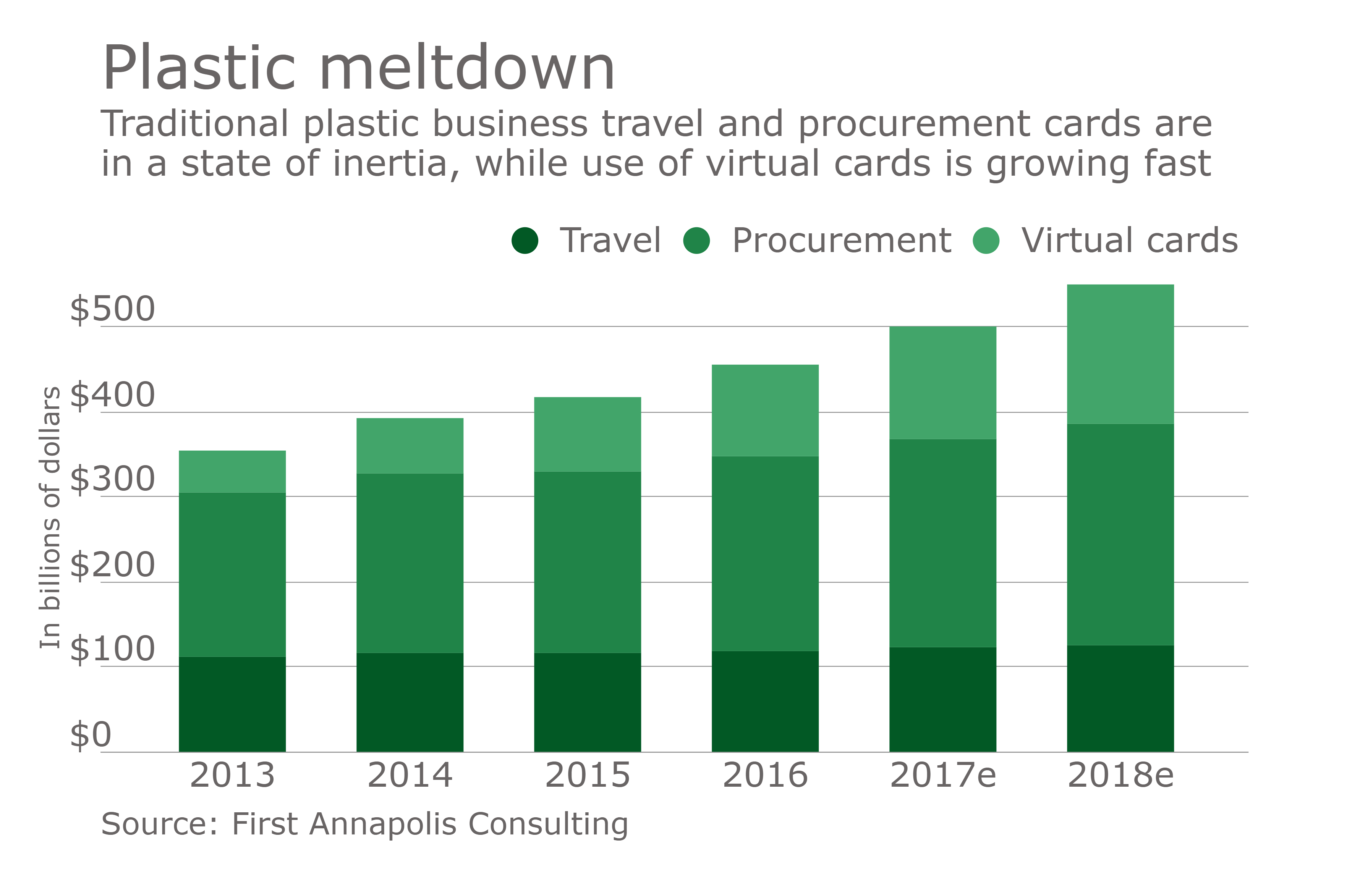

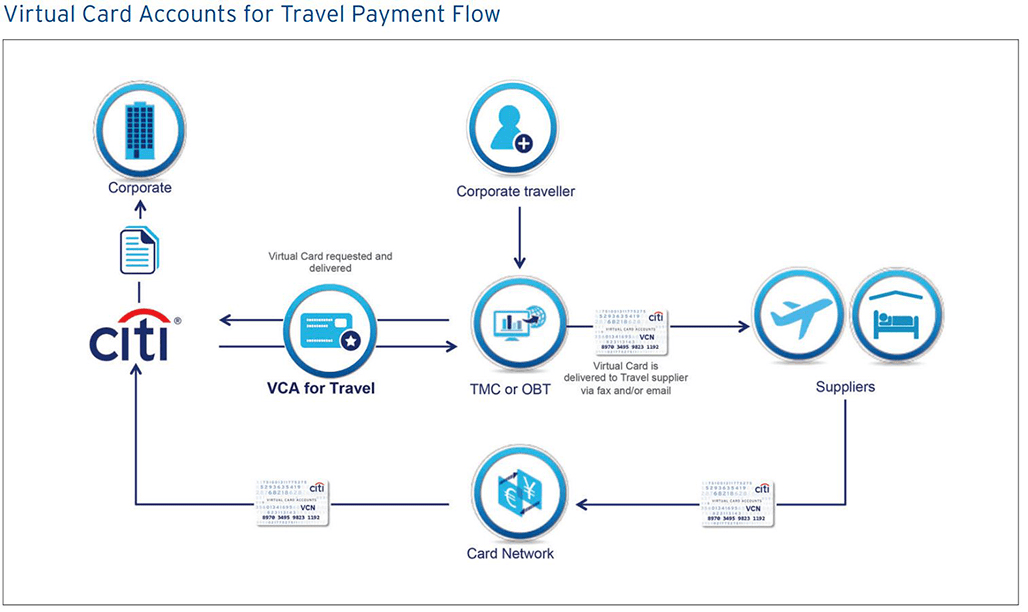

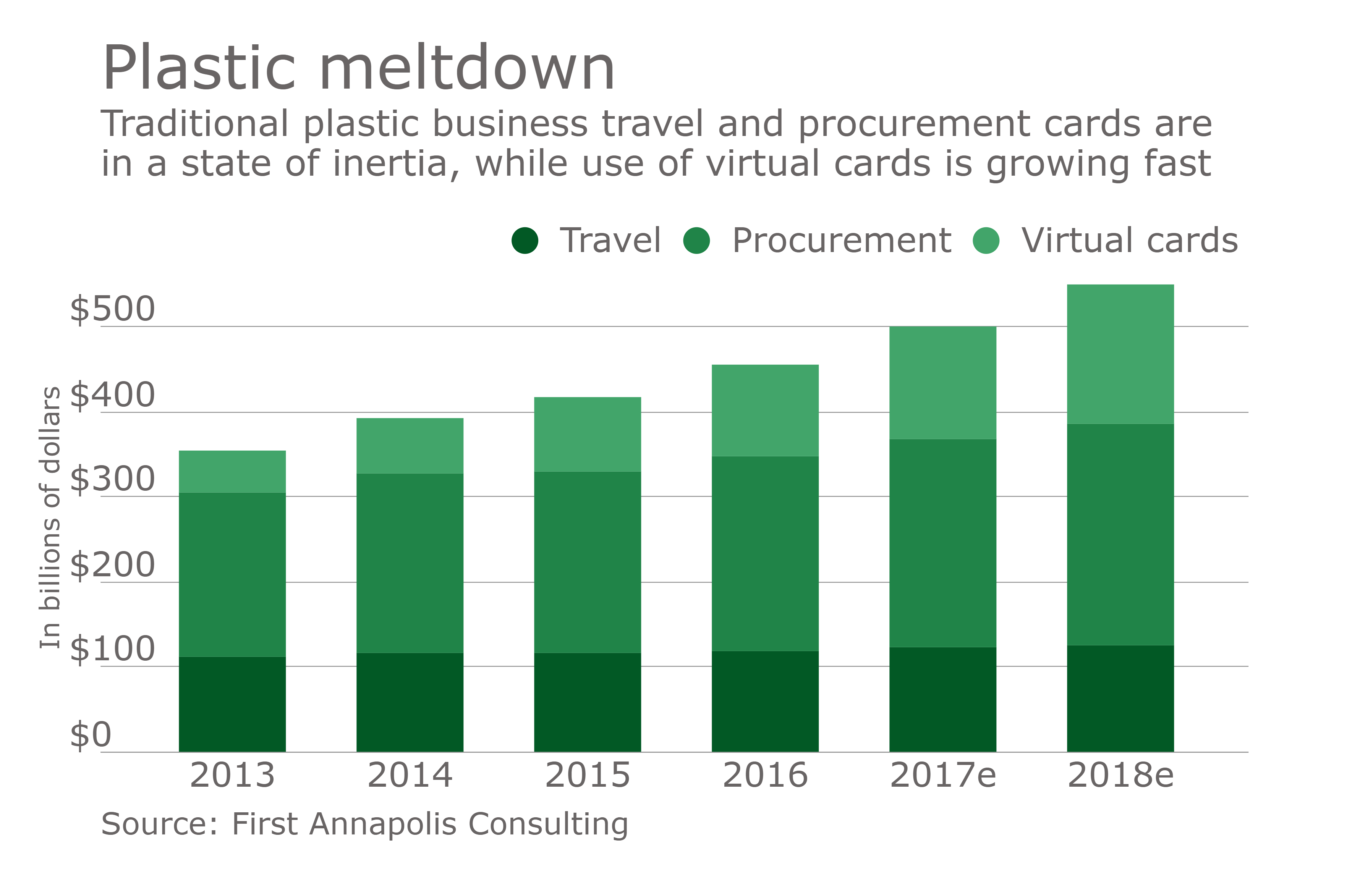

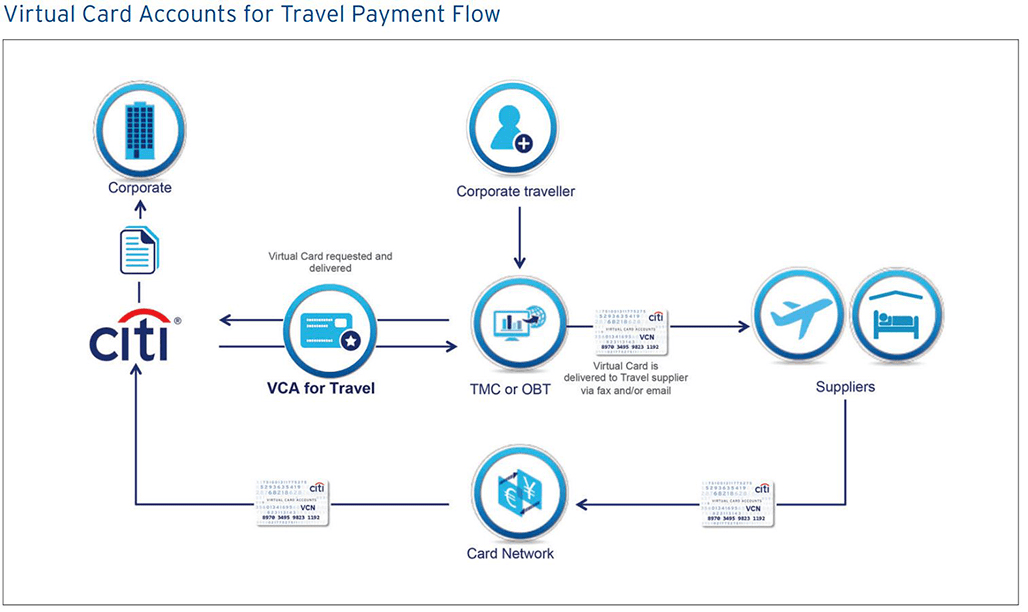

Citibank includes virtual cards in its product line for corporate clients. According to the bank’s research, “virtual card is the fastest growing segment of the commercial card market and is predicted to grow at 19% annually through 2022 due to buyer commitment, improved connectivity and enhanced supplier acceptance”.

American Express modestly

promises to “compliment your corporate card program and add to your convenience”.

iCard who have no relation to Apple

call you to “draw a line between your personal and business accounts to easily manage your cash flows”. Your partners and suppliers will “enjoy instant money transfers at competitive rates”, and there are also mass payments for “affiliate payouts, ongoing subscription services and purchases from multiple suppliers”.

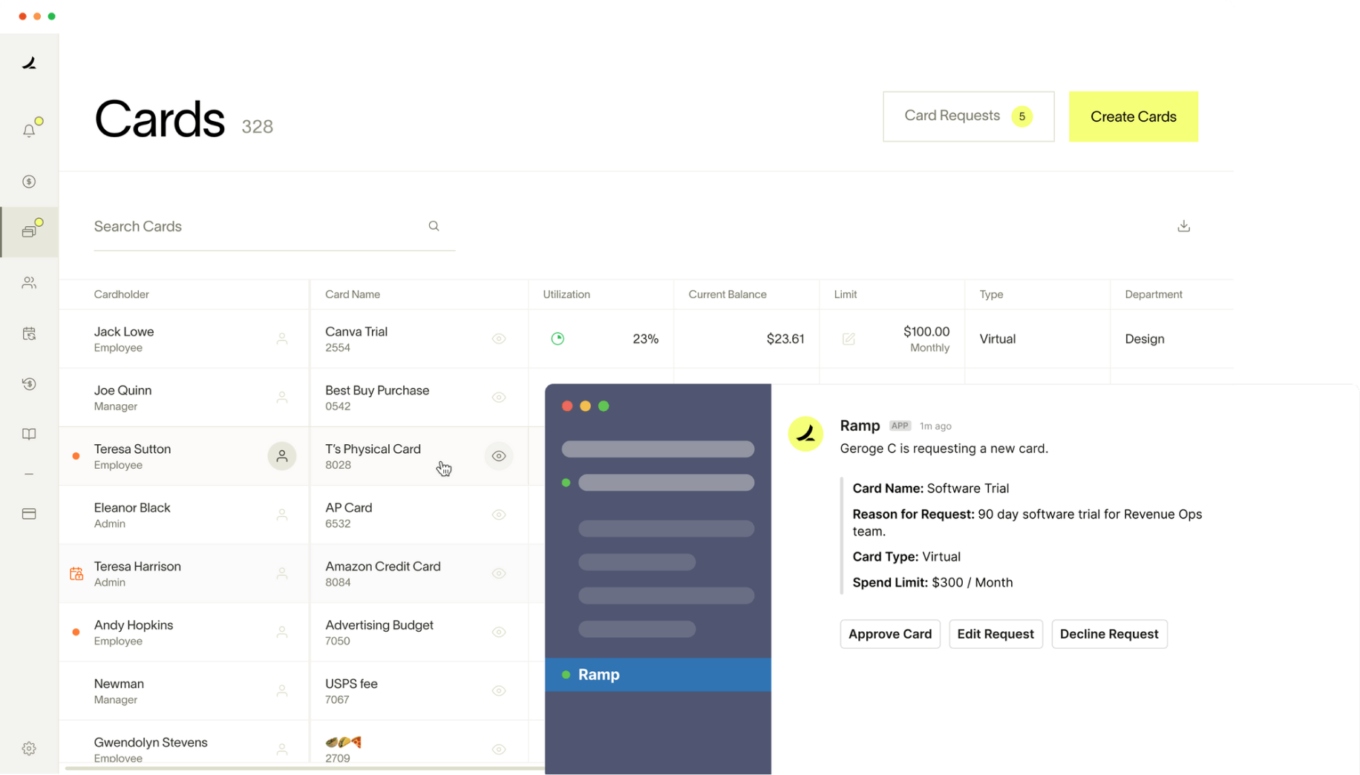

Rampboasts with “heightened security, full integration with your accounting system, greater flexibility, and cash back rebates” as well as an “automated expense management platform”.

Marqetais proud with their speed and efficiency, and shares these with the world through an open API platform.

In

Airwallex they

know why virtual cards are especially handy for smaller companies: easilly issued, conviniently used, they help business “move at a much faster pace by allowing the purchasing of new software and equipment without delays”.

Not to be confused with

Airbase who

offer no less than a unified spend management software platform for paying bills, managing corporate cards, reimbursements, approvals, accounting automation, and real-time reporting.

Embursecan do a lot: role-based permissions and approval flows, automatic expense categorizations, real-time insights and reports, mobile receipt capture and reminders, and so on.

Soldohas separately tuned solutions for big and smaller businesses, non-profits and startups. It only works with the residents of the The European Economic Area, but it’s a trait of all fintech companies: regulations tie them up to sertain jurisdictions.

Divvy: they

say, it’s free.