Living in the modern world means having to adapt quickly, as this world is constantly changing. Step by step, we’re learning how to protect ourselves from online threats. We choose various means to browse anonymously: switch to Tor or Brave, use Incognito mode, install a VPN and an ad blocker. We change passwords from time to time trying not to use the same one for multiple accounts. The best-case scenario is having a password manager. But few people think about how to protect their credit card details.

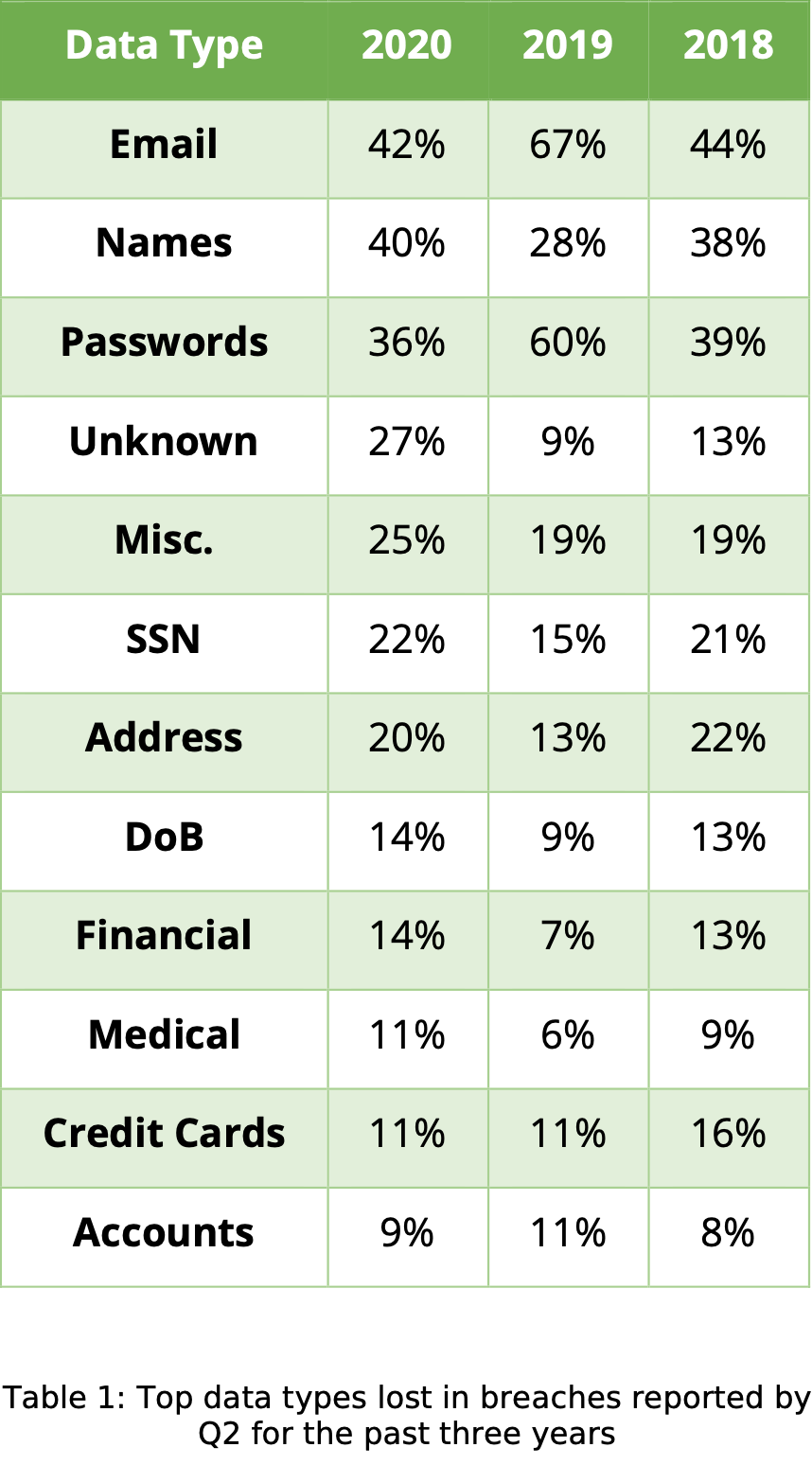

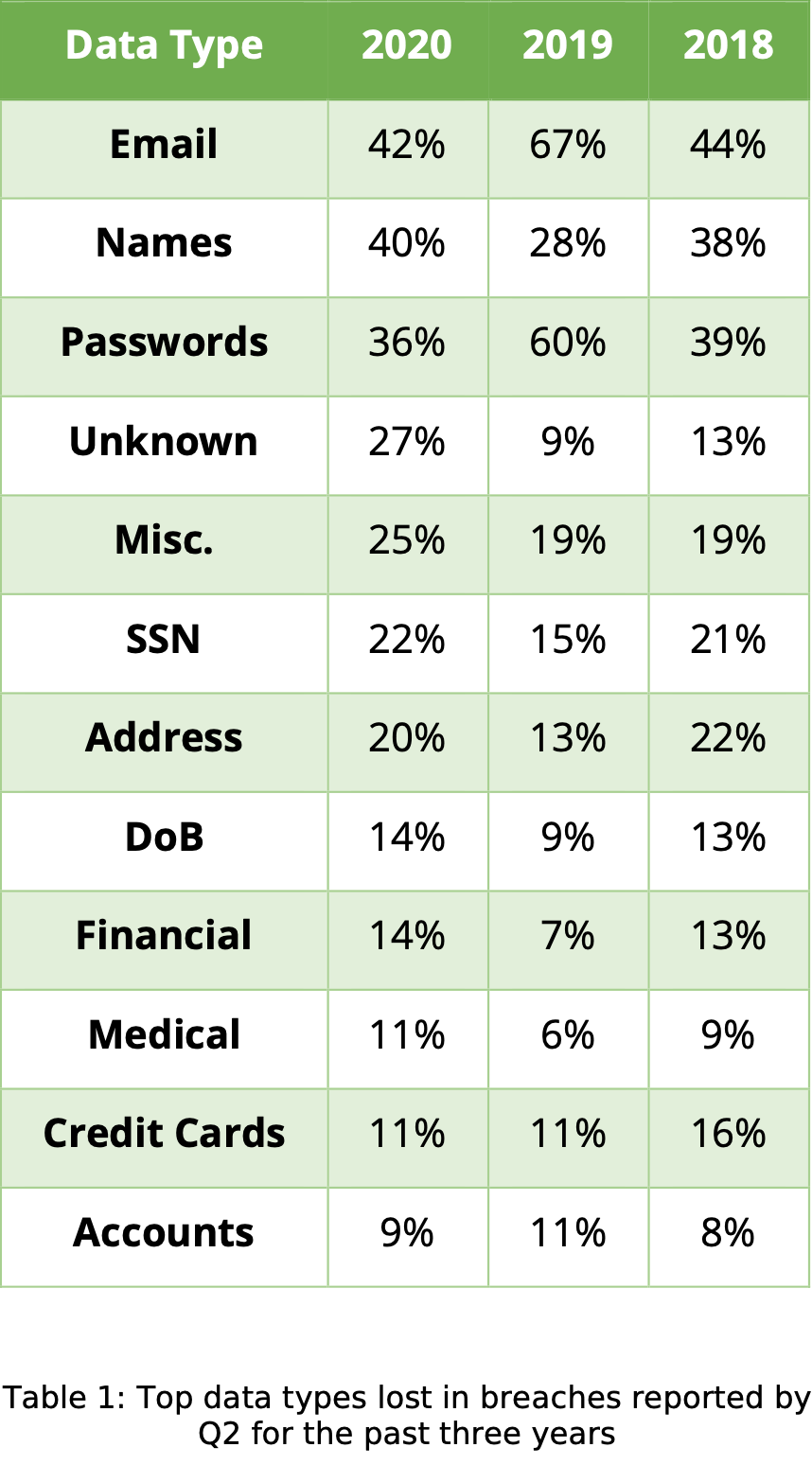

According to

the 2020 MidYear Data Breach Report by Cyber Risk Analytics, ‘the number of payment card details exposed in the first six months of 2020 surpassed 90 million records’. The report covers different breach types: ‘Hack’, ‘Virus’, ‘Web’, ‘Skimming’, and ‘Unknown’. Some breaches include ransomware as an element of the attack, and some ransomware attacks begin with phishing for access credentials.

Credit cards are among data types that are most likely to be leaked. In both

2019 and 2020 MidYear Data Breach reports, 11% of credit cards were exposed.

Luckily, now there is a possibility to prevent this.

What virtual credit cards are and how they work

Virtual credit card is a credit card number that can be used for online payments. The card issue is instant, usually free of charge, and you can get as many cards as you want. Virtual credit cards don't exist in physical form as one can guess from the name, they are meant to be used electronically.

Virtual cards are gaining more and more popularity, and some credit card issuers already provide an option to use this type of cards. If you request this feature, you’ll get a card number, its expiration date, and security code (CVV) – like any normal card. When you use it to pay online, the transaction will appear in your bank account as if it was made from your real card. Yet, your real credit card details won’t be visible to the merchant. Pure magic.

Previously, cards were issued only by banks, but now there are many fintech services that issue cards dedicated for certain operations. For instance, there are multi-currency travel cards that convert currency at a profitable exchange rate. But today we’d like to talk about virtual cards tooled up for convenient and secure online payments.

5 benefits of using virtual cards

Spending control

We’ve all found ourselves in a situation where, after signing up for a free trial period, we forgot to cancel the subscription auto renewal. The subscription fee for the first month (or year) was charged from the card… and that really wasn’t necessary. Just a waste of money due to one’s own carelessness.

It’s often the case that you intend to pay once or take advantage of the free trial but the merchant has other plans and reckons that the card number he was given is an invitation to write off the money at his own discretion.

Burner cards are a popular format of virtual credit cards. They are also called single-use or disposable cards which means that they become invalid after the first purchase. Burner cards are a perfect fit to protect you from unwanted recurring payments. It’s easy to manage your subscriptions and prevent any unnecessary expense knowing that your card will be closed before free trial ends.

Protection against scammers and fraudsters

There are two most common types of attack that are credit card phishing and credit card data leaks. In case of phishing, scammers usually send you an email that pretends to be from your bank asking you to resubmit your account number, credit card number, and other personal data. If successful, they can not only rob your account, but also swindle other people using your name. To avoid this from happening, always keep in mind that a legit company will never request your sensitive information in an email, so you shouldn’t provide it.

One of the main purposes of virtual cards is protecting your actual credit card details from being stolen. Security and protection are spillover benefits caused by the fact that virtual cards can be issued in any quantity and instantly closed, and you don’t have to go to the bank or wait for a courier to get a new card. In the event of phishing or in the event that the merchant's website gets hacked and fraudsters snatch your virtual card details, it’s easier to stop them from spending your money.

Extra layer of security

Probably, the best thing about virtual credit cards is that they provide users with an additional level of security.

Should you fall victim to a credit card fraud, phishing, or data breach, you won’t have to go through the nine circles of hell with the card reissue. Another thing nobody finds enjoyable when losing a physical card is re-input your card details in a bunch of mobile payment services, Apple/Google accounts, etc.

Easy subscription cancellation

Has it ever happened to you that you were charged, knew about it, but couldn’t do anything because it would take too long to find out who wrote off your money and how to disable these charges? Not to mention the cases when you have to call a merchant and ask them to cancel your subscription. That is nonsense.

With virtual credit cards, it’s virtually simple. You can issue a separate card for each subscription and close any card right away without having to plough through the UI of a particular merchant and search where to cancel your subscription.

Sometimes the problem is to find who writes off your money — MID (merchant ID) in the bank statement may be not informative, so it happens that somebody charges your ATM card and you can’t figure out who it is.

Not just online shopping

Some virtual cards can only be used online, it depends on whether the card issuer supports mobile payment and digital wallet services like Apple Pay or Google Pay.

How virtual credit cards can help protect your security

As can be seen from the article, virtual cards add an extra level of security. This is particularly valuable at the time when data breaches and phishing seem to have taken hold and have spread far and wide. If a fraudster manages to get your virtual card details, you can quickly cancel this card leaving aside your physical credit card and other virtual cards.

When shopping online, it's important to stay alert and not let fraudsters obtain your personal and/or financial information to use your identity to commit fraud – i.e., to prevent identity theft.

Do try using a VPN when you're using a public Wi-Fi network. This measure can keep hackers from capturing your online activity and any sensitive information you share.

FAQ

What does virtual card mean?

A virtual card is a debit or a credit card number that can be used for online purchases. As the name suggests, virtual cards don’t exist in physical form.

How can I get a virtual credit card?

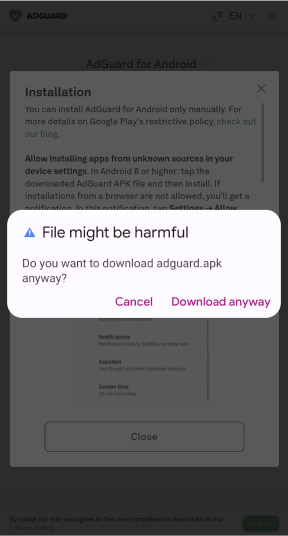

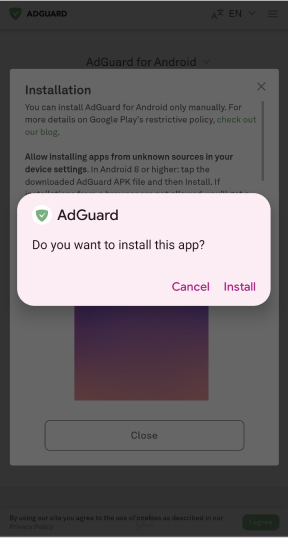

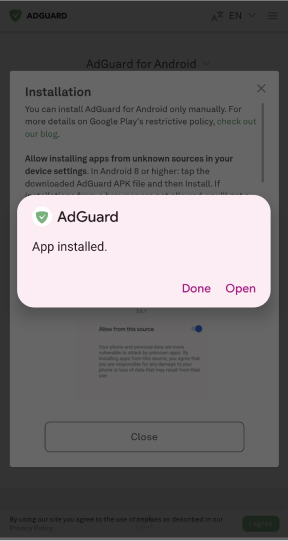

Some banks provide an opportunity to issue virtual cards. Besides, there are fintech services that sell prepaid virtual cards. AdGuard is going to launch a service for secure online payments specializing in virtual cards.

Follow the link to get on the waitlist.

What is the use of virtual cards?

Virtual cards can be used for online purchases. Besides, you can purchase paid apps in app stores and use mobile payment services like Google Pay and Apple Pay.

Can you use a virtual card at an ATM?

By nature, virtual cards cannot be used at automated teller machines (ATMs). If you wish, you can use a physical debit or credit card for that purpose.

Are virtual cards safe?

Generally speaking, virtual cards are as safe as regular plastic cards. The good thing about them is that you can issue a new virtual card every time you want to pay somewhere, which is definitely not the case for plastic cards. And that's the thing that makes your payments safer, i.e. not virtual cards themselves but the way they change how you pay online.