Perplexity offers $34bn for Google Chrome. Is this just a ‘publicity stunt’ or more?

UPDATE: Since this article was originally published, the court has delivered its final ruling. On September 2, Judge Amit Mehta issued a 223-page decision stating that while Google must share certain search data with “qualified competitors,” it will not be required to sell Chrome or Android. The judge ultimately rejected the DOJ’s request to break up the company. We may explore the implications of this decision and the reasoning behind it in a follow-up piece.

Perplexity AI, the first search engine built from the ground up with artificial intelligence, has made a surprise bid to buy Chrome, the most popular browser in the world, from Google. The company — currently valued at around $18 billion — is clearly aiming for the stars by offering to pay $34.5 billion for one of Google’s most prized assets.

Rival search engine DuckDuckGo's CEO, Gabriel Weinberg, along with analysts at Raymond James, estimate Chrome’s value at $50 billion, roughly one and a half times more than what Perplexity is reportedly offering. And according to Forbes, Chrome may actually be worth way more when considering its broader strategic value to Google.

Chrome serves as the gateway to the internet for an estimated 60% of global users, or about 3.5 billion people. That number alone underscores its importance. But Chrome isn’t just a browser, it’s the linchpin of Google’s digital advertising empire. Every morning, more than half of internet users open Chrome and see the familiar Google search bar. Every query typed, every click made, every bit of data generated — all of it feeds the massive ad engine that powers Google’s revenue. To put it simply, Chrome is the first window to the online world for billions, and overestimating its practical value to Google is almost impossible.

So, is Perplexity just pulling our leg? Is this a joke? Well, not completely.

Perplexity’s offer to buy Chrome

According to a term sheet seen by Reuters, Perplexity — if its bid is accepted — promises to keep Chromium open source, invest around $3 billion over the next two years, and (surprisingly) keep Google Search as Chrome’s default search engine.

Perplexity plans to fund the acquisition by enlisting support of private equity funds. The company says it will be backed by multiple funds, though it hasn’t revealed any names yet. So far, it’s a bit of a mystery.

Now, if Perplexity sticks to its word and keeps Google Search as the default, you might think, "Hey, maybe this isn’t such a terrible deal for Google after all." Sure, its grip loosens a bit, but the empire doesn’t totally collapse.

But here’s the real question — and it’s a big one:

Why on earth would Google even consider selling Chrome in the first place?

Google might be forced to sell Chrome

Here comes the kicker: Google would prefer not to sell Chrome and keep it to itself. However, it might be forced to.

A year ago, in August 2024, a judge ruled against Google in a massive antitrust case in the US. US District Judge Amit Mehta found that Google acted illegally to maintain a monopoly in the search engine market. That alone would’ve been a big deal — but what really turned heads were the remedies the US Department of Justice (DOJ) demanded.

Besides ending exclusive distribution agreements with phone makers like Samsung and Apple (which made Google Search the default and Chrome the default browser), the DOJ dropped a bombshell: it wants Google to divest from Chrome.

To put that in plain English:

The U.S. government wants Google to sell Chrome, the same way it wants ByteDance to sell TikTok.

Understandably, Google wasn’t exactly thrilled. And while it agreed to some of the demands like ending exclusive deals for preinstalling Chrome and Google Search as defaults, the idea of selling Chrome was just too much. Honestly, even giving up exclusivity wasn’t something Google did willingly.

What it actually did was remove the word “exclusive” from its contracts, while still insisting it should be allowed to make one-year deals with phone makers that require pre-installing Google apps. According to Google, these aren’t the same old exclusivity deals — they claim the new arrangements “eliminate any semblance” of monopoly tactics because manufacturers can preload competing apps too.

The judge, however, may not buy it still. Google conveniently left out any time limits on these new preloading agreements — unlike the one-year cap it proposed for browser deals — and that’s raised more than a few eyebrows in court. It begs the question if Google still gets front-of-the-line placement on every new device, how different are things really.

As for divesting from Chrome, Google gave a resounding “no” — and made it clear it’s willing to fight that battle to the very end. The company argued that losing Chrome would deal a major blow to the entire Google ecosystem, weakening products like Chrome OS and Chromebooks, and ultimately hurting consumers by lowering the quality and integration they’ve come to expect.

How likely is it that Google will be forced to sell Chrome?

Perplexity isn’t the only one who’s toyed with the idea of buying Chrome. OpenAI, Yahoo, and even a private equity firm have all shown interest in acquiring Chrome if the judge decides to break up Google.

Now, calling these bids mere publicity stunts would be a little too simplistic. There’s more going on here than headline-chasing. While we wait for the court to reach a final decision on the remedies, expected in the near future, divestment is still technically on the table.

That said, it’s looking less likely, at least according to the most recent reports.

In May, Judge Amit Mehta seemed to be leaning toward softer remedies for Google.He acknowledged that the search engine market is evolving, especially with the rapid rise of AI-driven technologies. And that shift may be influencing his thinking.

When it came to potential bidders like OpenAI or Perplexity, Mehta expressed skepticism that their involvement would truly serve the spirit of the antitrust remedies. His main concern was that these companies aren’t traditional search engines and therefore may not qualify as legitimate competitors in the market the case is actually about.

"It seems to me you now want to kind of bring this other technology into the definition of general search engine markets that I am not sure quite fits," Mehta said to DOJ attorney Adam Severt.

In other words, the judge appears to be questioning whether letting AI-first companies like OpenAI or hybrid models like Perplexity take over Chrome would do anything to restore competition in the general search market, which is the whole point of this case. If anything, it could just shift dominance from one tech giant to another — without fixing the core problem.

What happens if Perplexity buys Google Chrome?

Let’s imagine that Perplexity actually ends up buying Google Chrome. Such a move could reshape dynamics, not just for Perplexity and Google, but potentially across the broader search industry.

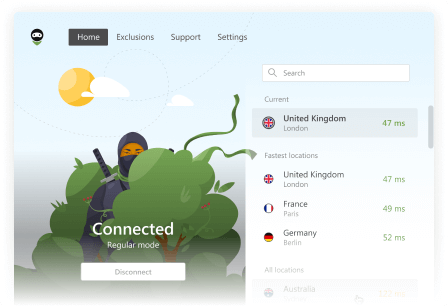

First of all, Perplexity already has a browser — it’s called Comet. The browser was recently unveiled and has been rolling out to Perplexity’s Pro users (meaning it’s currently a paid or invitation-only experience). It comes with an AI assistant built into the sidebar, an ad blocker, and a privacy mode. Unsurprisingly, the default search engine is not Google, but Perplexity itself.

Now, what happens if Perplexity buys Chrome — and why would it even want to, considering it already has its own browser? While Perplexity promises to keep Google Search as Chrome’s default search engine (for now), that sounds more like a temporary concession than a long-term plan, because as a long-term plan it does not make much sense.

What actually makes sense is this: Perplexity wants Chrome's user base. Buying Chrome gives it immediate access to a massive, global distribution channel. As Fortune puts it in their boldly titled article, “Is Perplexity the Next Google?”:

“For Perplexity, owning Chrome — should regulators allow it — would mean immediate access to billions of daily users, copious behavioral data, and the distribution muscle to push itself to the forefront of the AI race.”

Can Perplexity pull this off without Chrome?

Honestly, it’s not likely, at least not with the way Google currently dominates both the search engine and browser markets.

How will it affect users?

And if we stretch our imagination a little further and assume Perplexity does buy Chrome, the next question is: how will it impact users — if at all?

On the surface, probably not much, at least at first. Most users who are used to Chrome aren’t going to ditch it overnight, especially if Perplexity keeps Google Search as the default engine. Long-term, it’s tough to say. While Perplexity brands itself as a privacy-respecting company, even going as far as including an ad blocker in its Comet browser — the truth is a bit more complicated. The company has already introduced ads into its AI-powered search engine, and they appear alongside AI-generated answers. These are not just static banner ads, they’re integrated into the search flow itself.

That means Perplexity is already entering the world of ad revenue, and where there's ad revenue, there’s usually ad targeting, and behind that — data collection. So even if the browser blocks third-party ads, Perplexity’s own search product may still rely on user behavior and preferences to stay competitive and financially sustainable.

So, will Perplexity really be the company that pulls off the ultimate trick — marrying privacy and profitability? Will AI be the missing ingredient that makes that balancing act possible? We’ll see.

As bold and headline-worthy as the Chrome acquisition bid might be, it all hinges on one thing: whether Google will be forced to sell Chrome at all. So for now, everything, from Chrome’s future to Perplexity’s ambitions, and the balance of power in online search, is still hanging in the air.

That means we still have time to cook up wild theories and fantasize about a post-Google era where the web finally splits from its biggest gatekeeper.