What happens after Google (hypothetically) is broken up? Insights from AdGuard CTO

The potential breakup of Google could have far-reaching consequences for both consumers and the tech industry. If the US Justice Department forces Google to sell Chrome and syndicate Google Search search results, the search engine market could see much-needed diversification. The proposed final judgment would require Google to provide rivals and potential competitors with both user-side and ad data — at no cost and on a non-discriminatory basis — for a period of ten years. With Google’s search results and other data more accessible to third parties, rival search engines could leverage this data to improve their offerings and create more competitive alternatives. This could give users more choices and may even lead some to migrate away from Google, reducing the company’s ability to dominate data collection for targeted ads, which currently fuels most of its revenue.

However, the impact on consumers will depend on who ends up acquiring Chrome. Only a few tech giants have the resources to buy such a valuable asset, especially considering that Chrome is currently estimated to cost $20 billion. That means the competition for market share could become more concentrated, rather than decentralized, if the sale ends up in the hands of another tech monopoly like Amazon, which accounts for about 40% share of e-sales in the US.

New search market landscape

It will be interesting to see what the relationship between Google and Chrome looks like in the event of a forced sale. The new owners of Chrome may seek to negotiate an arrangement with Google that allows it to retain some level of control over the market. However, this will be a challenging proposition, as Google will be under intense regulatory scrutiny. Any agreement it enters into will likely face close examination to ensure it does not further entrench its monopoly — particularly through anticompetitive payments or other practices.

It will be equally interesting to see what happens to Google’s partnership with Apple. Recent court documents revealed that Google paid Apple a staggering $20 billion in 2022 just to remain the default search engine in Safari. If the judge accepts the DOJ’s proposed judgment then Google will be expressly prohibited from “offering Apple anything of value for any form of default, placement, or preinstallation distribution (including choice screens) related to general search or a search access point.” In the absence of such an agreement, Apple may be incentivized to resurrect its seemingly abandoned idea of creating its own search engine.

Depending on the goals of those who will acquire Chrome, it might so happen that the new owners will want to cut off Google’s access to Chrome, especially if they view Google as their main competitor.

The future of Android

Furthermore, while the Justice Department chose not to push for the outright sale of Android — viewing it as a last-resort option if Google continues its anticompetitive behavior — Google will still face substantial restrictions moving forward. The company would have to uncouple Android from other products like Google Search and the Google Play Store, which are currently bundled together. Google’s current dominance in the search space, through its exclusionary contracts and preinstalled apps, gives it control over around 80% of search queries. With the removal of these exclusionary agreements, the market could see intense competition, but this could also lead to an unpredictable landscape — where new players emerge, but also where some entrenched monopolies may benefit from the chaos.

In short, while the push for greater competition could benefit consumers in terms of more choice and privacy, the process could also create new challenges.

Impact on ad blockers

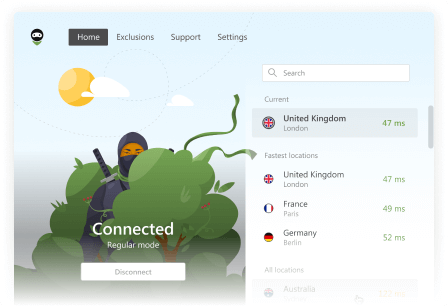

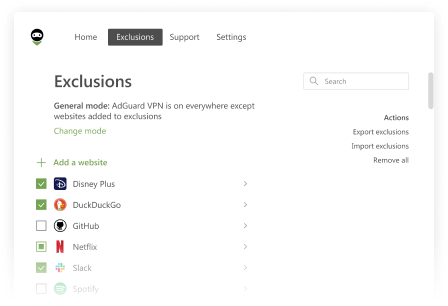

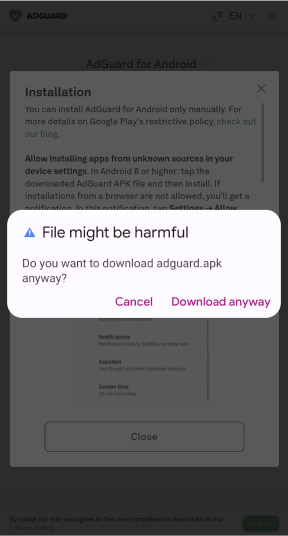

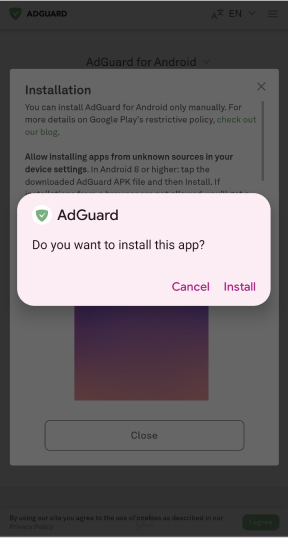

If Chrome is forced to relinquish its dominance and face more competition in the browser market, it could potentially change the ad-blocking landscape. Currently, most popular ad blocking solutions are browser extensions, with Chrome being the dominant platform due to its widespread usage and its Chromium-based derivatives. If users begin migrating to alternative browsers, developers of ad blockers will face the challenge of extending their solutions beyond Chrome, which could increase development costs and complexity. Smaller developers, in particular, may struggle with the resources required to maintain extensions across a growing variety of browsers, leading to a more fragmented market. However, ad blockers that offer cross-browser solutions or standalone apps will likely emerge stronger, as they are less dependent on specific browser ecosystems.

Additionally, with Google no longer holding a monopoly in the advertising space, we could see increased competition among advertising networks. This could lead to the emergence of new players, and consequently, ad blockers will need to adapt their filtering rules to account for new types of ads and networks.

Is a Google breakup imminent?

The proposal put forth by the Justice Department essentially takes a knife to Google’s empire and attempts to dismantle core parts of its business. It’s hard to imagine that the proposal will be accepted in full, particularly given the vast implications for Google’s global operations and the tech industry as a whole. Additionally, while the divestiture of Android has been mentioned, it seems unlikely that this will actually happen — at least in the short term. However, given the scale of regulatory pressure Google is facing, there’s still a possibility that the breakup could include substantial restrictions, particularly if the company fails to comply with antitrust regulations in the future.

It remains to be seen whether the judge will accept the DOJ’s proposed final judgment, and if so, whether the court will embrace the proposal in full or only in part. One thing is undeniable: the outcome of this process has the potential to shape the search engine and browser markets for years to come.